trust capital gains tax rate 2022

The maximum tax rate for long-term capital gains and qualified dividends is 20. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

How To Avoid Capital Gains Tax On Rental Property In 2022

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more. Your income and filing status make your capital. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more.

The financial impact of this tax grows in correlation with the size of your household income. Capital gains and qualified dividends. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. It would be simple to distribute all of the trusts current income to the trusts beneficiaries in order to avoid tax rates on the trusts income. Trust tax rates are very high as you can see here.

So for example if a trust earns 10000 in income during 2021 it would pay the following taxes. Again if the taxable gains plus your income remain in. With 247 trading and investment minimums as low as 10 its so easy to get started.

For tax year 2022 the 20 rate applies to amounts above 13700. Read on as we will examine. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The IRS typically allows you to exclude up to. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. An individual would have to make over 518500 in taxable income to be taxed at.

In other words if you are falling in 28 tax bracket short term capital gains in. 250000 of capital gains on real estate if youre single. For single tax filers you can benefit.

There are seven federal income tax rates in 2022. With 247 trading and investment minimums as low as 10 its so easy to get started. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Ad Estate Trust Tax Services. The tax rate for capital gains is as low as 0. Short term capital gains are taxed at the same tax rate that is applied to your normal income.

500000 of capital gains on real estate if youre married and filing. 4 rows The IRS has already released the 2022 thresholds see table below so you can start planning for. Capital gains and qualified dividends.

Based on filing status and. Above that income level the rate jumps to 20 percent. When you dispose of chargeable assets you will pay 20 Capital Gains Tax if you are a higher or additional rate taxpayer.

The top marginal income tax rate. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital.

The capital gains tax consequences of the disposal of assets in a trust and of low or interest free loans have taken centre stage as taxpayers restructure their affairs and their trusts. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. You would owe capital gains tax on your profit of 5.

2022 Long-Term Capital Gains Trust Tax Rates. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable. However long term capital gain generated by a trust still. The standard rules apply to these four tax brackets.

10 of 2650 all. 20 for trustees or for personal representatives of someone who. For example if you purchased real property for 400000 and sold it ten years later for 500000 you would realize a gain of 100000.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. Determining when capital gains taxes are.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

Stacey Staceylynnhaslett Instagram Photos And Videos Investing Finance Capital Gains Tax

Capital Gains Tax What Is It When Do You Pay It

2021 Trust Tax Rates And Exemptions

Florida Real Estate Taxes What You Need To Know

San Diego Capital Gains Tax On A Second Home In 2022 Capital Gains Tax Capital Gain San Diego

2021 Capital Gains Tax Rates By State Smartasset

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How To Pay 0 Capital Gains Taxes With A Six Figure Income

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Tax What Is It When Do You Pay It

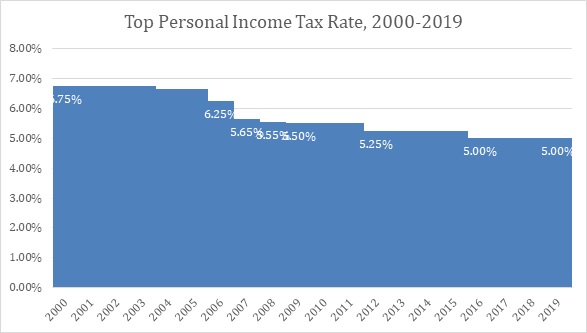

Individual Income Tax Oklahoma Policy Institute

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021